Content

Based on your estimated total income, remove the tax deductions from it. Do the same calculation for each quarter if differences in income vary. You may need to understand how deferred tax liability works. It stems from a “book-tax difference,” which is largely https://www.bookstime.com/ a difference of timing between financial accounting rules and IRS rules. The sales tax rate differs based on where your business has a physical presence. If you structure your business like a C corporation, your company becomes a separate legal entity.

Plan Now to Avoid Social Security COLA Tax Cliff in 2023 – ThinkAdvisor

Plan Now to Avoid Social Security COLA Tax Cliff in 2023.

Posted: Wed, 30 Nov 2022 16:19:54 GMT [source]

There are two types of exemptions-personal and dependency. While each is worth the same amount, different rules apply to each. A concept of tax fairness that states that people should pay taxes in proportion to the benefits they receive from government goods and services. A business authorized by the IRS to participate in the IRS e-file Program. The business may be a sole what is tax liability proprietorship, a partnership, a corporation, or an organization. Authorized IRS e-file Providers include Electronic Return Originators , Transmitters, Intermediate Service Providers, and Software Developers. For example, an ERO can at the same time, be a Transmitter, a Software Developer, or an Intermediate Service Provider, depending on the function being performed.

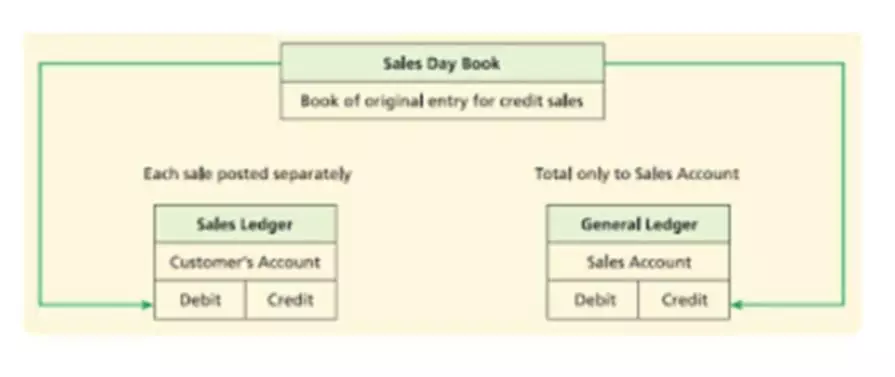

Calculating tax liability

For example, in the first quarter, let’s say your income was $14,000, while your qualified business deductions were $6,500, leaving you taxable income of $7,500 for the quarter. It’s important to calculate your tax liability for several reasons, but one of the main reasons is that it allows you to properly budget for the expense. Calculating your tax liability can also help you make more targeted business decisions or take a closer look at your expense deductions. Finally, knowing the tax liability for your business helps you have more accurate financial statements. When the amount of a credit is greater than the tax owed, taxpayers can only reduce their tax to zero; they cannot receive a “refund” for any excess nonrefundable credit. The transmission of tax information directly to the IRS using telephones or computers. Electronic filing options include Online self-prepared using a personal computer and tax preparation software, or using a tax professional.

- They’re also one of the most visible tax types to most individuals.

- At the end of every taxation period, taxes are imposed by the local, state, or central government.

- Once the tax base is acquired, the tax rate is determined.

- In a progressive income tax system, rates rise as income rises.

- If you don’t have many deductions to claim, you’ll probably want to claim the standard deduction.

Minimizing tax preferences broadens the tax base, so that the government can raise sufficient revenue with lower rates. Most Americans pay more in payroll taxes than they do in income taxes. Deferred tax liability, also known as DTL, refers to the tax owed by a business that has not yet been resolved or paid. In most instances, this occurs because of the discrepancy between business accounting methods and tax structures. As you read above, employers are responsible for withholding certain amounts of income to cover the employees’ tax liabilities.

Due Date of Returns and Payments

Taxpayers who have overpaid their tax through withholding or declaration of estimated tax must file a return to obtain a refund or credit. Taxes on economic transactions, such as the sale of goods and services. These can be based on a set of percentages of the sales value (ad valorem-sales taxes), or they can be a set amount on physical quantities (“per unit”-gasoline taxes). To mail or otherwise transmit to an IRS service center the taxpayer’s information, in specified format, about income and tax liability. This information-the return-can be filed on paper, electronically (e-file). A concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay tax at different rates.